AI SaaS: The Next Big Wave for Startups and Investors in India

Market sizing: Global and India context

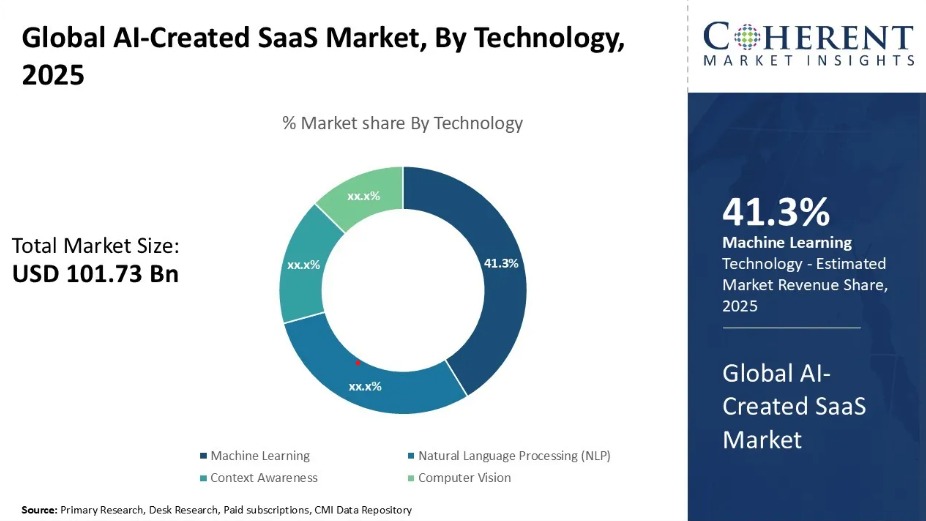

Global SaaS and AI forecasts vary by source, but the directional signal is unanimous: AI-enabled SaaS is growing at CAGR north of 30% in many forecasts. A practical way to think about the opportunity for India: even a modest capture of global AI SaaS demand by Indian startups translates into multi-billion-dollar addressable markets over the next 5–8 years.

Source: Coherent Market Insights

India’s AI opportunity is also large and accelerating. A Nasscom–BCG study projects India’s AI market to reach approximately $17 billion by 2027, driven by enterprise digitization, rising AI talent, and increased investments in automation and analytics. That domestic demand — plus India’s growing export of SaaS — creates both a local adoption base and a global supply pipeline of AI talent and products.

Capital flows corroborate the trend. Private equity and growth investors have significantly increased commitments to enterprise SaaS in India: PE investments in Indian enterprise SaaS surged in early-2025, signaling strong institutional confidence in the sector’s scalability and exit prospects. Read More

Why India is advantaged for AI SaaS?

- Talent density & technical usage: India produces large cohorts of engineers and ML practitioners; usage patterns show Indian teams are early adopters of advanced AI tools for development tasks — a practical indicator of both supply and demand for AI tooling.

- SaaS playbook maturity: India has already scaled global SaaS winners (product-led growth, developer-first distributions). The GTM, pricing and onboarding playbooks are transferable to AI-first products.

- Cost & operational leverage: Lower engineering costs combined with global cloud availability mean Indian teams can iterate models and products faster per dollar of spend.

- Large domestic customer base with global ambitions: Fintech, retail, edtech, BFSI and enterprise services in India are investing in automation and AI, giving startups a runway to validate ROI locally and scale internationally.

Case studies: Playbooks that matter

Company | Category | Playbook & Signal |

Freshworks | Enterprise SaaS (CRM) | Scaled via product-led growth and global SMB focus; revenue scale demonstrates the exportability of Indian SaaS playbooks. (FY revenue >$700M). Read More |

Observe.AI | Contact-center AI (AI SaaS) | Built product defensibility through domain data + speech AI; raised large growth capital to expand model & customers ($125M Series C). Explore |

Suite + embedded AI | Embedding proprietary LLMs and agent frameworks into a broad app suite signals how incumbents will incorporate AI as core differentiator. (Zoho’s Zia LLM launches reflect the enterprise trend.) Know More |

Investor lens: Signals to underwrite and metrics to watch

For saas venture capital firms and other venture capital firms in India, the underwriting checklist for AI SaaS is different from classical SaaS:

Key signals:

- Domain Data Ownership: Does the startup collect and own data that meaningfully improves model outputs (and is hard to copy)?

- Early Expansion Metrics: Net Dollar Retention (NDR) >100% in early cohorts indicates AI features are expanding usage.

- Time-to-Value: AI must reduce time-to-value; shorter onboarding and measurable ROI drive adoption.

- Compute & Cost Strategy: Startups that demonstrate a pragmatic inference strategy (hybrid on-premise + cloud, model distillation) manage unit economics better.

- Regulatory & Safety Posture: In regulated verticals, compliant data handling and model governance are table stakes.

Valuation & capital dynamics: AI SaaS can command premium multiples when growth is visible and model-driven features create durable expansion. However, capital discipline matters — compute costs can creep up quickly. Investors should prefer teams that combine ML expertise with product & GTM rigor.

Seafund POV: Why we are optimistic?

At Seafund we view AI SaaS as a structurally different wave: it compresses product differentiation into features that materially change customer workflows. Our bullishness is grounded in three convictions:

- Data wins: Founders who own vertical data (voice, payments, claims, sensor telemetry) can improve models and create value that competitors can’t easily replicate.

- Practical AI, not hype: The winners will be those who deploy AI to automate repetitive tasks and improve outcomes (not just flashy demos).

- Capital-efficient scaling is possible: With smart model choices, hybrid deployments, and strong product-led distribution, AI SaaS can be both fast-growing and capital efficient.

Seafund is actively scouting founders who pair domain expertise with data ownership and have a clear path to measurable ROI for customers. For us, the ideal AI SaaS founder is a product leader who treats ML as a feature set that must earn its place in the customer’s P&L.

Risks & guardrails

While the AI SaaS landscape is ripe with opportunity, it’s equally important to acknowledge the structural challenges that can affect scalability and long-term defensibility. As with any transformative technology wave, the line between early promise and sustained profitability is defined by how startups manage these emerging risks.

- Model Commoditization

The rapid rise of open-source large language models (LLMs) like Llama 3, Mistral, and Falcon — coupled with API-based models from OpenAI and Anthropic — has drastically lowered the barrier to building AI-enabled products. This commoditization means that “AI-powered” features no longer guarantee differentiation.

Guardrail: AI SaaS startups must focus on proprietary data loops, domain-specific fine-tuning, and embedding AI deeply into customer operations so that switching costs rise over time. The winners will be those who turn model performance into measurable business impact rather than novelty.

- Rising Compute & Inference Costs

AI workloads are capital and compute intensive, often eroding the traditional margin advantages of SaaS. For every 1,000 API calls or model queries, inference costs can scale non-linearly with usage.

Guardrail: Founders must design model-efficient architectures—using techniques like quantization, distillation, and model caching—to bring inference costs down. Hybrid deployment models (cloud + on-prem) and leveraging specialized inference hardware (e.g., Nvidia TensorRT, AWS Inferentia) can restore unit economics closer to traditional SaaS benchmarks.

- Data Privacy, Security & Compliance

As AI SaaS solutions often involve analyzing customer data, they face heightened scrutiny under data protection laws like the EU’s GDPR, India’s Digital Personal Data Protection Act (DPDP, 2023), and emerging AI governance frameworks.

Guardrail: Companies must adopt privacy-by-design principles — encrypting data, ensuring local storage compliance, and providing explainability in automated decisions. Building audit trails, bias monitoring, and secure model training environments will soon become a standard expectation, not an optional feature.

- Ethical and Responsible AI Deployment

Beyond compliance, responsible AI has become a brand differentiator. Customers, regulators, and investors are increasingly evaluating how models handle fairness, bias, and accountability.

Guardrail: Incorporating model interpretability tools, ethical review processes, and transparent disclosure about model capabilities and limitations will be essential for enterprise adoption. The next generation of AI SaaS products will likely compete on trust as much as on performance.

- Market Saturation and Overhype

The AI SaaS ecosystem has seen an influx of startups, many of which are feature-level applications built atop the same foundational models. Over time, the market will undergo natural consolidation, favoring products with deep domain integration or clear network effects.

Guardrail: Founders should focus on vertical depth over horizontal sprawl—building AI solutions that become indispensable in a specific industry (e.g., healthcare, manufacturing, logistics), rather than trying to serve all use cases superficially.

Conclusion

AI SaaS is no longer theoretical — it’s a material shift in how software delivers business outcomes. For deeptech startups in India and venture capital firms in India, the window to capture category-defining positions is open. Seafund’s thesis is simple: back teams that own vertical data, execute on pragmatic ML, and can demonstrate measurable customer ROI. If you’re building at that intersection, we’d love to hear about your product, data and go-to-market.

FAQs

1: How is AI SaaS different from traditional SaaS?

AI SaaS embeds machine intelligence directly into the product. Instead of static software, it learns from usage, automates decisions, and expands inside customer accounts—driving faster time-to-value, higher retention, and product-led growth. AI doesn’t support the product; AI becomes the product.

2: Is India competitive against US/EU AI SaaS startups?

Yes. India has top-tier engineering talent, PLG-driven SaaS playbooks, lower build/iteration costs, and a fast-growing automation market. Global enterprises already source AI/ML from India, making even a small share of global AI SaaS demand a multi-billion-dollar opportunity.

3: What do investors evaluate in AI SaaS?

Investors look for data ownership, strong unit economics, usage-based expansion, and clear ROI. Proprietary datasets, inference efficiency, early NDR > 100%, and measurable workflow automation are core signals for underwriting AI SaaS.

4: If LLMs are commoditized, how do AI startups stay defensible?

Models may be commoditized, but data, workflow depth, domain expertise, and switching costs are not. Defensibility comes from vertical focus, proprietary datasets, automation embedded in core processes, and performance that improves with scale.

5: What kind of AI SaaS founders do investors want?

Investors back founders with domain depth, data leverage, and capital efficiency. Teams building practical AI that reduces cost, improves decisions, and drives expansion—not demo-ware—stand out. If you fit that profile, investors want to talk.

Table of Content

- 1. Market sizing: global and India context

- 2. Why India is advantaged for AI SaaS

- 3. Case studies: Playbooks that matter

- 4. Investor lens: Signals to underwrite and metrics to watch

- 5. Seafund POV: Why we are optimistic?

- 6. Risks & guardrails

- 7. Conclusion

- 8. FAQs