Understanding the Stages of Early-Stage Funding in India: A Complete Breakdown

Introduction

In India’s startup ecosystem, understanding the “stages of early-stage funding” is critical whether you’re a founder seeking investment or an investor evaluating deals. For many entrepreneurs the terms “seed”, “Series A”, “pre-seed”, “growth” are used loosely. But clarity matters: stage determines investor expectations, valuation brackets, milestone timelines, and dilution dynamics.

As India enters 2026, the funding landscape is both maturing and tightening. According to recent data, early-stage (seed + Series A) funding in India witnessed a slowdown: seed-stage funding in H1 2025 dropped to USD 452 million (-44% vs H1 2024) while early-stage overall stood at USD 1.6 billion (-16% YoY). Read More

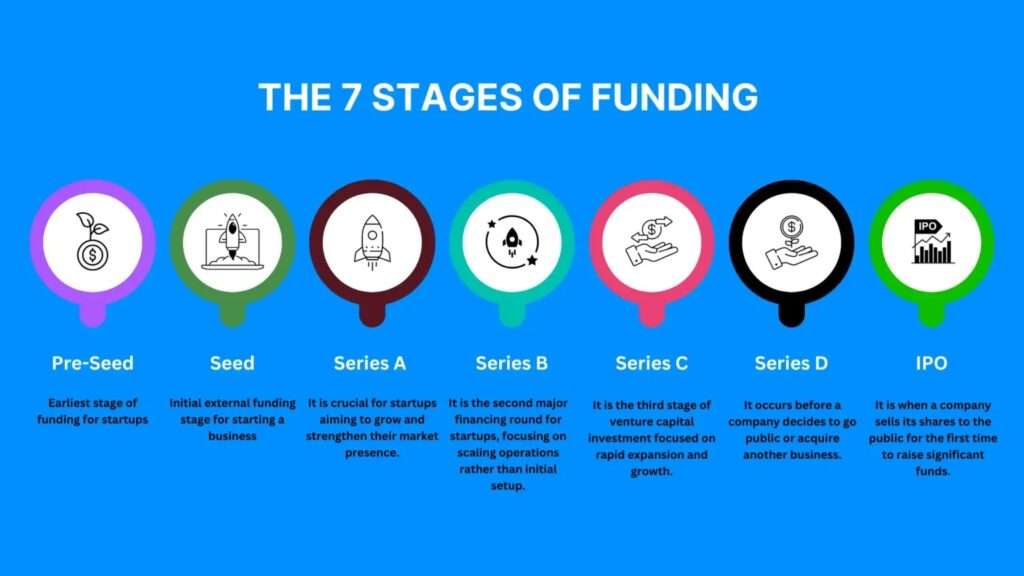

Definitions: What Are the Funding Stages?

Below is a simplified breakdown of the commonly used stages in India’s early-stage funding spectrum.

Stage | Typical Purpose | Typical Check-Size / India Context* |

Pre-seed / Angel | Founders validate idea, build MVP, early customer/proof-of-concept. | ~US$100k-500k (varies widely) |

Seed | Product market fit seeks validation, initial traction, early hires, “go-to-market” pilot. | In India, could range US$0.5–3 m (≈ ₹4-25 cr) |

Series A (Early stage) | Scaling product/market fit, building team, repeatable business model, looking at meaningful growth. | India: ~US$3–15 m typical. Read More |

Series B & Growth onward | Scaling operations, international expansion, major revenue ramp, possibly exit path. | >US$10 m+ and a commensurate valuation. |

* Note: These are indicative; actual ticket sizes vary by vertical (deep-tech, SaaS, hardware), geography, investor appetite.

Why does stage-definition matter?

- It sets investor expectations (what you should have achieved).

- It influences valuation and dilution (earlier = higher risk = lower valuation).

- It defines what milestones you must hit before raising the next round.

- It shapes your fundraising timeline and strategy (how many months/years until next raise).

Investor Expectations by Stage

Here’s a breakdown of what investors typically expect at each funding stage in the Indian market.

Source: Startup Rise Asia-Pacific

Pre-seed / Angel

- A founding team with domain expertise or strong prior experience.

- Early prototype/MVP or at least idea plus validation plan.

- Clear value proposition and initial market insight.

- Some user interest, pilot customer or LOI ideally.

- Willingness to accept high risk and long time to exit.

Seed

At this stage, the investor is looking for:

- A working product or clear MVP with initial users/customers and measurable engagement.

- Evidence of product-market fit or strong hypothesis.

- Founding team plus early hires (e.g., tech, go-to-market).

- A credible go-to-market strategy, target metrics (CAC, retention) even if early.

- Plan for next 12-18 months: how the money will be used, major milestones.

- Reasonable dilution (often 10-25 %) depending on valuation.

Series A (Early Stage)

Investors expect:

- Already some measurable traction (revenue, paying customers, repeatable model) rather than just “idea”.

- Clear unit economics or path to them.

- Scalable model: ability to grow team, expand markets, build processes.

- Strong metrics: e.g., ARR, growth % MoM, churn, margin improvements.

- Intention/plan for further rounds, possible exit paths.

- Governance, investor readiness, professionalised operations.

Series B and Beyond

- Significant revenue scale, ideally profitability or path to profitability.

- Expansion into new markets (geographic or product).

- Competitive moat: IP, brand, distribution, cost advantage.

- Institutional investor involvement, potential merger/acquisition/IPO strategy.

- Strong management team, often with external hires for scale operations.

Funding Timeline & Benchmarks for India

Here’s a rough timeline and benchmarks for Indian startups in early-stage, especially in tech/hardware/hybrid contexts. Note: Deep-tech companies often take longer and need higher tickets.

Stage | Approx Time to Reach | Key Milestones |

Pre-seed → Seed | 6-18 months | MVP built, early customers/pilots, team in place |

Seed → Series A | 12-30 months | Product-market fit, recurring revenue (ideally), scalable GTM, measurable traction |

Series A → Series B | 18-36 months or more | Significant ARR, growing team, multi-market presence, strong unit economics |

India Funding Context: Late‑2025 / Early‑2026

Data from the first half of 2025 signaled a shift in India’s startup funding landscape. Seed-stage funding dipped to about USD 452 million (‑44 % YoY), while early-stage funding (seed + Series A) totaled around USD 1.6 billion (‑16 % YoY). Total startup funding for 2025 eased to roughly USD 10.5 billion, a 17 % drop from 2024, though early-stage deals remained relatively resilient at USD 3.9 billion, reflecting investors’ focus on measurable traction and scalable models. Read More

Implications for founders:

- Align your funding ask with your current stage – overreaching is risky.

- Demonstrable traction – revenue, paying customers, or unit economics – is critical.

- Investors are selective, prioritizing rounds that clearly accelerate growth.

In this environment, stage-fit, milestones, and scalability are more important than ever as India moves into 2026.

Key Metrics & Characteristics by Stage

Here are some typical metric-benchmarks (though always variable by sector) that investors use to assess stage readiness:

Stage | Metrics to Show | What Investors Focus On |

Seed | Prototype/MVP, early users, MoM growth %, CAC, churn (if any) | Team strength, product-market fit hypothesis, runway |

Series A | ARR or MRR (for SaaS), paid customers, growth % (e.g., 5 – 10%+ month-on-month), unit economics, retention curves | Scalability, business model repeatability, process readiness |

Series B+ | Significant revenue (US$5+ m+ ideally), gross margin, EBITDA progression, multi-geography or major product expansion | Market leadership, global ambition, exit potential |

For deeper tech/hardware startups:

- Additional metrics: TRL (Technology Readiness Level), manufacturing/scale readiness, IP/patents, gross-margin improvement via scale, supply-chain robustness.

- These startups may raise larger tickets but also run longer timelines and higher risks; investors will model longer runway and larger capital commitment.

How This Applies to Indian Founders & Investors

From Seafund’s vantage point (as a deep-tech early-stage investor), the key take-aways for Indian founders are:

- Aim for the right stage: Align your ask with what you’ve actually achieved. Don’t present a “seed-stage ask” when you’re still pre-product, nor a “Series A” ask when you lack traction.

- Focus on measurable milestones: Given the tighter environment, investors want to see early validation, customers, or pilots—even at seed.

- Build for scalability and capital-efficiency: Early days matter. Investors ask: “What happens when we inject X ₹ crore — what major milestone will you hit?”

- Plan for follow-on investment: Even beyond your current round, know how you will hit next round. Deep-tech especially needs longer horizon.

- Expect tougher scrutiny in 2025: As data shows, early-stage funding is down; valuations compressed; investor patience higher.

- Tell the story of global ambition & scalable model: India is large, but investors increasingly look at global potential and repeatable business models.

Quick Reference Table: Funding Stage Summary

Stage | Purpose | Typical India Ticket | What You Should Provide |

Pre-seed | Idea → MVP | US$0.1-0.5 m | Founding team + prototype + market insight |

Seed | Validate & scale initial model | US$0.5-3 m | MVP in market, early users/pilot, GTM plan, team build |

Series A | Scale model & business | US$3-15 m | Revenue or strong traction, scalable model, growth metrics, unit economics |

Series B+ | Major expansion | US$10 m+ | Significant revenue, market leadership, international expansion, clear exit path |

Conclusion

For Indian startups – especially those in deep-tech, hardware or hybrid models – the roadmap from idea to exit encompasses distinct funding stages, and each stage carries different expectations. As 2026 marks a more disciplined phase of funding in India, founders must sharpen their stage readiness, build measurable traction, align their ask with actual progress, and demonstrate the ability to scale – not just locally, but globally.

At Seafund, we encourage founders to map their milestones, understand investor psychology, and present a clear vision for scale and exit. Know your stage. Raise accordingly. And build with clarity. Because in today’s environment, the right stage-fit and execution can make all the difference.

FAQs

- What are the early-stage funding stages in India?

Pre-seed, seed, and Series A are the main early-stage funding rounds in India. - How much funding is raised at the seed stage in India?

Seed rounds typically range from US$0.5–3 million, depending on sector and traction. - What do investors expectatSeries A?

Revenue or strong traction, scalable business model, and clear unit economics. - Why is early-stage funding slower in India in 2025?

Investors are cautious due to market correction, focusing on metrics and capital efficiency. - How should founders prepare for early-stage fundraising?

By aligningthe funding ask with traction, milestones, and growth readiness.

Table of Content

- 1. Introduction

- 2. Definitions: What Are the Funding Stages?

- 3. Investor Expectations by Stage

- 4. Funding Timeline & Benchmarks for India

- 5. Key Metrics & Characteristics by Stage

- 6. How This Applies to Indian Founders & Investors

- 7. Quick Reference Table: Funding Stage Summary

- 8. Conclusion

- 9. FAQs