What Venture Capitalists Look for in Deeptech and AI Startups in India 2026

India’s deeptech and AI ecosystem is evolving faster than ever. With the government’s push for applied research, the rise of compute infrastructure, and a maturing talent pool, 2026 is shaping up to be a defining year for founders building frontier technologies. Amidst this growth, one question is critical:

What exactly do venture capitalists look for when evaluating deeptech and AI startups in India?

Unlike SaaS or consumer tech, deeptech investing is inherently high-risk, IP-driven, capital-intensive, and dependent on long development cycles. This means VC criteria are sharper, more technical, and thesis-driven.

In this blog, we break down these criteria through industry trends, founder insights, and Seafund’s own investment perspective.

- WhyDeeptech& AI Startup Funding in India Is Rising in 2026

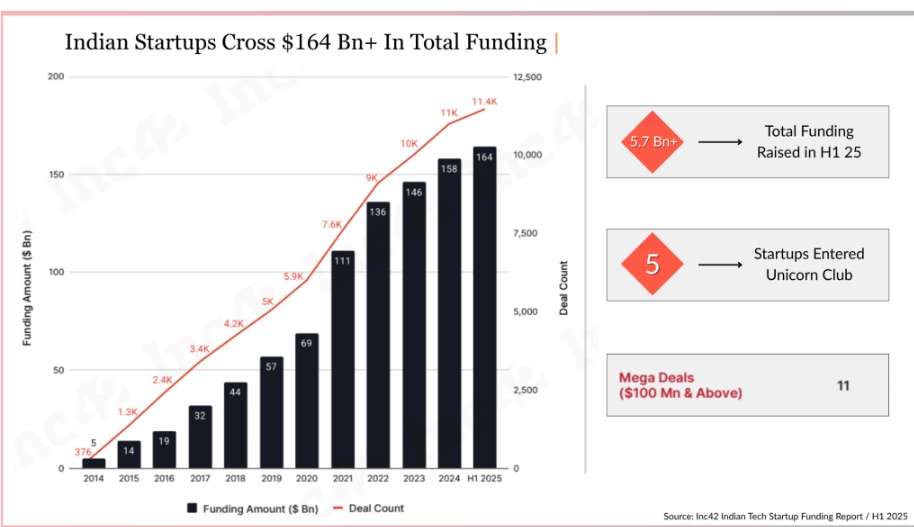

Despite market corrections across tech, AI and deeptech remain the fastest-growing VC categories.

Key 2025 Drivers

Factor | Why It Matters |

Government initiatives (IndiaAI Mission, Digital Public Infrastructure) | Democratizes AI compute, encourages indigenous innovation |

Surge in applied AI adoption across BFSI, healthcare, mobility | Increased enterprise demand shortens go-to-market cycles |

Academic talent pipeline from IITs, IISc, and research labs | Strong technical leadership for early-stage teams |

Rise of micro-VCs, corporate VCs, and deeptech-focused funds | More specialised capital entering frontier tech |

With more founders entering this space, the need for clarity on VC criteria in India has never been stronger.

Source: Inc42 Media

- The Core VC Criteria forDeeptech& AI Startups in India

Below is a breakdown of the eight key dimensions most VCs—including Seafund—use when evaluating companies.

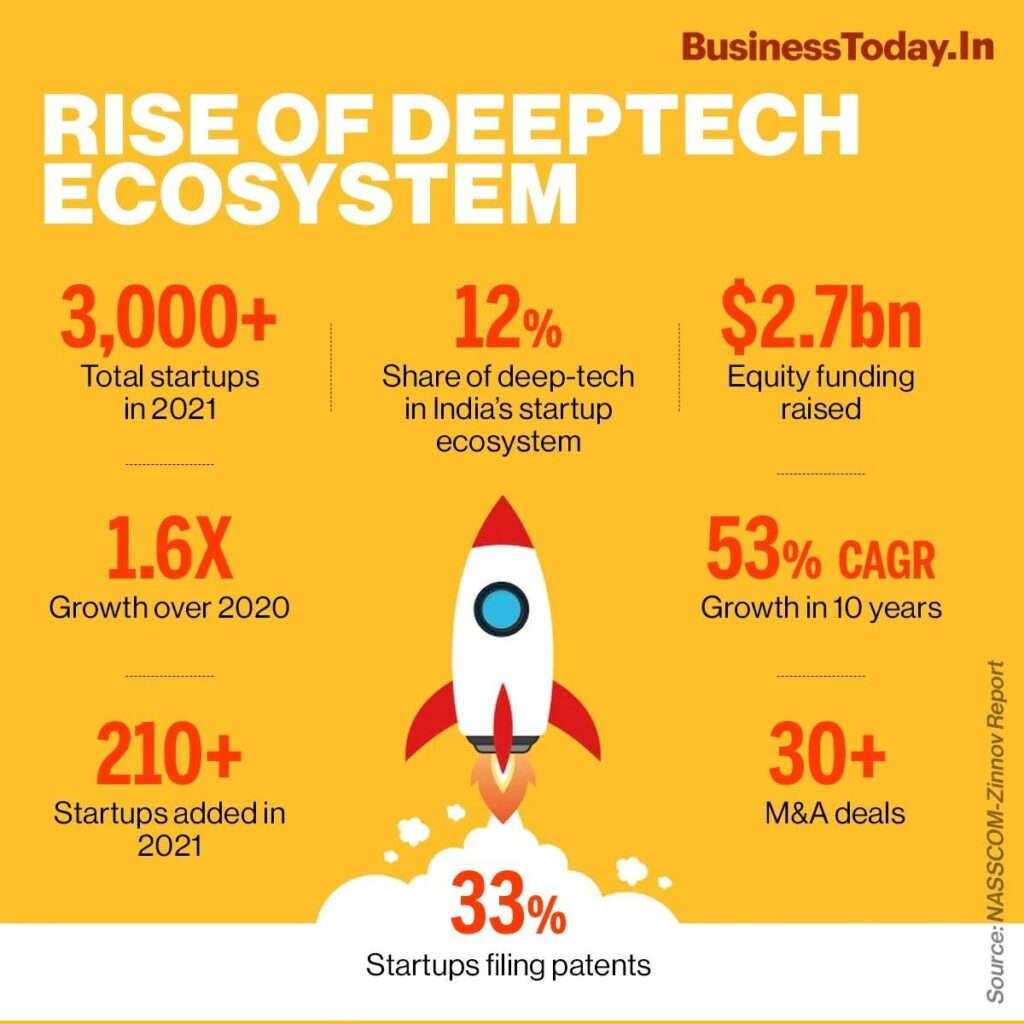

Source: Business Today

2.1 Technical Depth & IP Defensibility (Most Critical)

Deeptech evaluation begins with technology differentiation, not market traction.

VCs examine:

- Is the IP defensible? (patents, provisional filings, trade secrets, algorithms)

- Is the technology 10x better than existing alternatives?

- Does it rely on core science or proprietary datasets?

- Is it easily replicable?

2.2 Commercial Viability & Time-to-Market

India’s AI/deeptech ecosystem historically faced long commercialization hurdles. But in 2026, enterprises adopt AI faster than expected—particularly in healthcare, logistics, insurance automation, climate-tech, and robotics.

VCs assess:

- How soon can the technology generate revenue?

- Is there a clear path from R&D → MVP → enterprise pilot → ARR?

- Does the product solve a high-value problem?

2.3 High-Value Problem Statement

VCs avoid “AI for AI’s sake.” Investment flows to problems that are:

- Large

- Expensive

- Chronic

- Poorly solved today

Examples: AI in medical imaging (diagnostic backlog), predictive maintenance for infrastructure, edge AI in industrial automation, robotics for logistics.

2.4 Team Quality, Research Rigor & Founder-Market Fit

A strong team is often the dealmaker:

- Technical founding team with research experience (PhDs, patents, lab work)

- Complementary business and product leadership

- Ability to attract and retain specialized talent

- Grit for long development cycles

Common founder red flags: Overestimating AI capabilities, weak scalability understanding, brilliant tech with zero GTM clarity.

2.5 Data Advantage & Model Performance

VCs now ask:

- What datasets power your model?

- How accurate and robust is it (precision, recall)?

- Does it improve with more data?

- What’s the compute strategy: cloud, edge, hybrid?

Data flywheels—unique, compounding advantages—are central to VC evaluation in 2026.

2.6 Scalability & Unit Economics

Even in deeptech, sustainability outweighs speed. VCs assess:

- Cloud/compute cost vs. revenue potential

- Cost of inference

- Hardware & deployment complexity

- Customer acquisition strategy

A scalable model today means predictable costs, replicable deployments, and steady margins.

2.7 Market Size & Sector Maturity

VCs favor segments with rapid enterprise adoption, clear regulatory pathways, and global relevance.

2026 Hot Sectors

Sector | Why VC Interest Is Strong |

AI-first healthcare (radiology, pathology) | High demand + government digitization |

Robotics & automation | Labour gaps + infra modernization |

Climate-tech | Policy incentives + global supply chain demand |

Industrial IoT + Edge AI | Manufacturing upgrade wave |

Cybersecurity AI | Exponentially growing threat volume |

2.8 Alignment to India’s Digital Public Infrastructure (DPI)

Deeptech startups gain an edge by leveraging India’s DPI:

- ONDC

- IndiaAI Compute Infrastructure

- Ayushman Bharat Digital Mission

- UPI ecosystem

- Logistics & Industrial DPI (ULIP & ONDC)

VCs want to see how technologies plug into national-scale networks, creating adoption and defensibility.

- Common Deal-Breakers VCs See

Top 10 VC Deal-Breakers:

- Weak IP or easily replicable models

- “We’ll figure out GTM later”

- High inference costs with no optimization plan

- Overreliance on third-party models

- No regulatory clarity

- Lack of customer validation or LoIs

- Unrealistic timelines to MVP

- Founder not full-time

- Zero moat beyond engineering talent

- Poor defensibility vs. Big Tech

- Investor Interview Insights: Common Questions

Technical: What’s the core scientific innovation? Proprietary model/data? Accuracy at scale? Compute costs at 10x?

Business & Market: Enterprise deployment model? Pilot-to-contract cycle? Market size?

Financial: Burn rate? Compute cost % revenue? Breakeven timeline?

Risk & Compliance: Data privacy? Regulatory approvals?

- How Early-Stage VCs LikeSeafundEvaluate Deeptech Startups

Seafund’s approach combines founder-first diligence with deep technical analysis:

Criteria | Seafund’s Focus |

Technology & IP | Novelty, patents, defensible engineering |

Founding Team | Research pedigree + product execution |

Market | High-value industrial/enterprise problems |

GTM Strategy | Enterprise-ready deployment clarity |

Moat | Data advantage + engineering moat |

Capital Efficiency | Smart compute usage, disciplined cycles |

Regulatory Fit | Especially in healthcare, drones, infra |

Seafund also partners with founders to:

- Sharpen value propositions

- Validate enterprise demand

- Optimize compute architecture

- Build early pilots in India’s fast-growing industries

This founder-centric model creates sustainable, deeptech-first companies, not just valuation-driven startups.

- Conclusion: What Founders Should Prioritize in 2026

To secure VC funding in India, founders must present defensible, scalable, and enterprise-ready businesses.

Final VC Checklist for Deeptech & AI:

- Strong IP with difficult-to-replicate engineering

- Clear path from research → product → revenue

- Efficient compute strategy

- Enterprise-ready product design

- Strong founding team & research background

- Alignment with India’s industrial and digital growth

Founders who build with these principles have the best chance of raising capital and scaling into global deeptech leaders.

- FAQs

- What do venture capitalists look for indeeptechstartups in India?

VCs focus on strong IP, deep technical differentiation, high-value problem statements, scalable unit economics, and a capable founding team with research and execution strength. - Is it harder to raise funding for AI anddeeptechstartups in 2026?

Yes. While funding volumes have increased, deal counts have dropped, meaning investors are backing fewer but higher-quality startups with clearer paths to commercialization. - How importantisIP and patents for deeptech funding?

Extremely important. Defensible IP—patents, proprietary algorithms, or unique datasets—often determines investment decisions, especially at early stages. - Which sectors are attracting the mostdeeptechVC funding in India?

Top sectors include AI-first healthcare, robotics & automation, climate-tech, industrial IoT, edge AI, and cybersecurity, driven by enterprise demand and policy support. - Do VCs in India funddeeptechstartups without revenue?

Yes, but only if there is strong technical validation, early pilots, clear enterprise interest (LoIs), and a credible roadmap from R&D to revenue.

Table of Content

- 1. Why Deeptech & AI Startup Funding in India Is Rising in 2026

- 2. The Core VC Criteria for Deeptech & AI Startups in India

- 3. Common Deal-Breakers VCs See

- 4. Investor Interview Insights: Common Questions

- 5. How Early-Stage VCs Like Seafund Evaluate Deeptech Startups

- 6. Conclusion: What Founders Should Prioritize in 2026

- 7. FAQs