The Future of Startup Funding in India: Beyond Unicorns to Enduring Startups

In recent years, the narrative around funding for startups in India has often gravitated toward unicorn‑chasing: billion‑dollar valuations, mega‑rounds, and rapid scale. But today’s market dynamics are shifting. Investors and founders alike are placing increasing emphasis on unit economics, sustainable growth and durable business models. For venture capital firms, especially those backing early stage ventures, this transition is not just a trend, but a strategic inflection point. At Seafund, our perspective centres on building enduring startups — not just the next “one‑day” unicorn, but companies that thrive over the long term.

From Unicorn Fantasies to Unit Economics & Sustainability

The unicorn‑culture of the 2018‑2022 era placed heavy emphasis on “growth at all costs” and market share as a proxy for success. But as valuations recalibrate and markets mature, the spotlight is shifting to financial discipline, operational efficiency, and strong fundamentals.

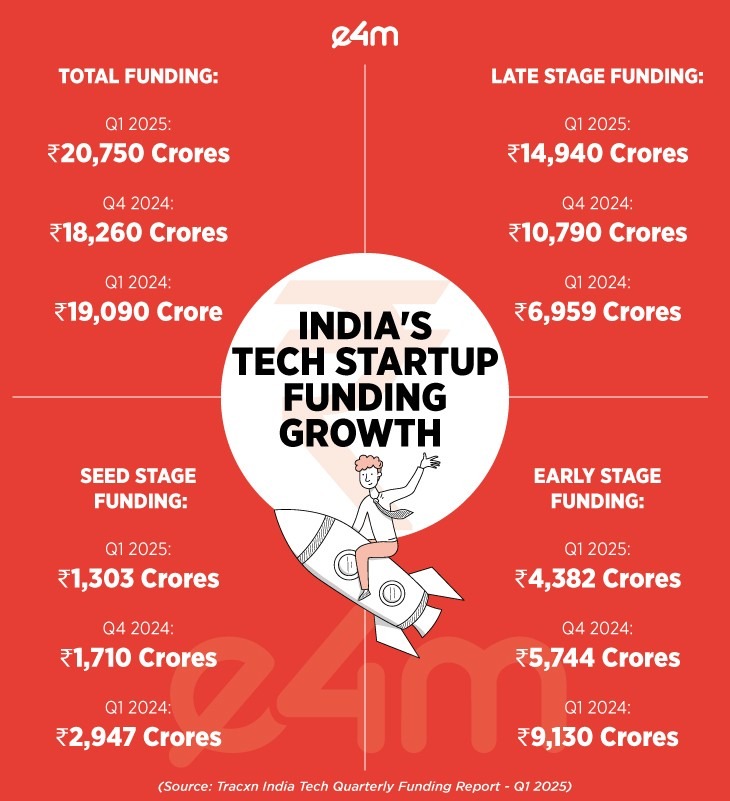

- Data confirms this: in the first half of 2025, Indian startups raised about US$4.95 billion across ~410 deals, a modest 9 % year‑on‑year increase — but still well below the peaks of 2021/22.

- Q3 2025 in particular saw funding slip to ~$2.1 billion across 240 deals, down some 38 % from the same quarter a year earlier.

- What this indicates is a more cautious investor mindset: fewer mega‑rounds, heightened scrutiny on burn‑rates, and stronger emphasis on business models that generate free cash flow, or at least credible paths to profitability. Read More

- For founders, this means the lens has widened: securing “startup seed funding India” isn’t just about raising large checks; it’s about showing traction, unit economics, repeatability. For investors, the focus is clear: backing companies that can scale meaningfully, generate value, and have the resilience to weather market cycles.

Source: e4m

Sectors Gaining Traction: Climate‑tech, Health‑tech, Deep‑tech

As the macro landscape evolves, the sectors that investors are favouring are likewise shifting. Traditional consumer internet plays (food‑delivery, hyper‑local) are maturing; the next wave is in deeper, structural domains.

- Health‑tech / Med‑tech: With India’s ageing population, rising chronic disease burden and under‑penetrated care infrastructure, startups that enable delivery, diagnostics, remote‑monitoring, palliative care, etc., are increasingly in focus.

- Deep‑tech: According to a December‑2024 KPMG report, deep‑tech in India (AI, robotics, quantum, advanced materials) accounts for ~12 % of the startup universe (3,600+ companies) and raised ~US$850 million in funding in 2023.

- Climate‑tech / Clean Mobility: India’s net‑zero ambitions, large decarbonisation opportunities, and supportive policy tailwinds mean that startups addressing mobility, batteries, circular‑economy, renewables are gaining investor attention.

- Enterprise SaaS & Infra: While still important, enterprise platforms with strong unit economics are also back in vogue, especially as profitability matters.

For the “venture capital funding startup companies” universe in India, this means shifting bets — away from purely consumer‑facing, high‑burn‑growth firms toward companies with strong domain moats, defensible technology, and long‑term runway. At Seafund, our thesis emphasises precisely these domains.

Sector | Key Trend | Example Insight |

Health‑tech / Med‑tech | Growing because of ageing population, delivery gaps | Mentioned in section “Sectors gaining traction” |

Deep‑tech / Advanced hardware | Big bets in quantum, AI chips, etc. (Semiconductor Engineering) | Q1 2025 saw three quantum‑hardware companies raise $100M+ |

Climate‑tech / Clean mobility | Supported by policy tailwinds and infrastructure needs | See KPMG/StartupIndia ecosystem reports |

Evolution of VC Models: Micro VCs, Corporate VCs, Sector‑Focused Funds

Parallel to the shift in startup models, investor models themselves are evolving. A few observable trends:

- Micro/seed‑focused funds: Smaller funds are stepping in at pre‑seed/seed stages, filling a gap left by larger funds that are now focusing on growth and late‑stage rounds. This means earlier access for founders, but also more rigor.

- Corporate VCs & strategic funds: Many corporates are launching funds tied to strategic objectives (e.g., sustainability, industry transformation), which align with deep‑tech/clean‑tech agendas.

- Sector‑focused funds: As domains mature, funds with domain specificity (health‑tech, climate‑tech, deep‑tech) are emerging, bringing domain expertise, value‑added support, and network effects.

An ecosystem report notes the Indian VC market is moving from “exotic to vibrant”, with a recalibration of expectations and investment models.

For startup founders looking at “startup India seed funding investors”, this means the pool is broader albeit more disciplined — it’s no longer only about ticking “unicorn potential”, but about sustainable growth, clarity of path, and investor value‑add.

Seafund’s model aligns with this shift: focused early‑stage checks, domain‑specific support, and candid collaboration with founders.

How Early Stage Venture Capital Firms Are Reshaping Founder Journeys

In the new funding landscape, early‑stage VC firms are doing more than writing cheques — they are shaping entire founder journeys. Key ways this is manifesting:

- Operational support: Beyond funding, early‑stage VCs are enabling go‑to‑market, hiring, compliance, metrics, and unit economics conversations — especially important in sectors like health‑tech and deep‑tech.

- Follow‑on discipline: Many early‑stage funds are reserving meaningful capital for follow‑ons, ensuring that founders don’t hit a funding cliff after initial momentum.

- Domain and network value‑add: In sectors requiring specialist knowledge (think climate, materials, life science), VC firms provide domain networks, corporate tie‑ups, regulatory support, etc.

- Unit‑economics focus: Early‑stage rounds are no longer just about “scale fast” — founders must show gross margins, customer‑LTV metrics, retention, capital‑efficiency.

Indeed, one dataset notes that while India’s startup funding ecosystem counted ~180,000 ventures in 2025, valuations and investor confidence increasingly hinge on real growth, revenue and market potential rather than pure hype.

For Seafund‑backed founders, the journey is guided: pre‑seed/seed stage checks, deep‑tech or climate/health domain focus, hands‑on support, and a shared goal of building durable platforms, not short‑lived flash growth.

Seafund’s POV on “Enduring Startup Building”

At Seafund, our view is simple yet rigorous: we believe that India is moving from an era of “making unicorns” to “building enduring startups” — companies that survive, scale, and deliver meaningful value over a decade or more. Here’s what that means for us:

- Investment Discipline: We focus on early‑stage (seed to pre‑Series A) companies where unit economics matter, and time to value is meaningful.

- Sector Focus: Our core sectors include deep‑tech (AI/ML, semiconductor, advanced materials), climate & mobility tech, health‑tech and enterprise SaaS. This aligns with where capital is flowing and where structural advantage exists.

- Support Ecosystem: We offer more than capital. Our support spans domain mentorship, corporate connections, regulatory navigation, hiring assistance, and go‑to‑market frameworks (see internal link [insert “Portfolio & Value‑Add” page link]).

- Long‑Horizon Mindset: Not every investment is about quick exit. We believe in building companies with 5‑10 year horizons, which might mean slower growth, but stronger foundations.

- Partnership Over Transaction: We work with founders as long‑term partners, enabling follow‑on funding, helping with fundraising strategy, and aligning on exit pathways.

By embracing this philosophy, we aim to be part of the “next wave” of Indian startups — ones that are not defined by splashy valuations alone, but by resilience, profitability, technical depth, and real‑world impact.

What This Means for Founders & Investors

For founders seeking startup seed funding in India, these shifts translate into new imperatives:

- Focus on business models with clear unit economics (LTV / CAC, retention, margin).

- Build for durability — treat scale as important but not at any cost.

- Choose investors who bring domain‑value beyond cheque‑writing.

- Consider sectors where structural tailwinds exist (climate‑tech, health‑tech, deep‑tech) rather than chasing broad consumer‑internet hype.

For investors looking at “venture capital funding startup companies” in India, the mandate is evolving:

- Smarter capital deployment, with smaller rounds but more rigorous discipline.

- Earlier intervention in domain‑rich sectors with longer horizons.

- Alignment on founder‑journey, support, follow‑on funding, and value‑creation beyond valuation leaps.

- Measurement of success not just via exits, but via enduring business value, customer impact, and sustainable growth.

Closing Thoughts

India’s startup funding landscape is at a pivot. The “unicorn‑first” mindset is giving way to the “enduring‑startup” mindset. And for early stage venture capital firms like Seafund, this is a moment of opportunity — to back companies that are positioned for longevity, not just velocity.

By aligning with sectors where deep value resides, focusing on unit economics, and partnering deeply with founders, we believe the next decade will be defined by startups that last — not just blaze brightly and fade fast.

In an ecosystem driven by “funding for startups in India”, this means seed funding, growth funding, but above all, smart funding with substance. As you consider your next round, your next hire, your next major strategic move — ask yourself: is this built to endure? Because at Seafund, our bet is not on unicorns, but on companies that outlast the hype.

FAQs

- What is the current trend in startup funding in India?

India’s startup funding landscape is shifting from unicorn-chasing to sustainable growth. Investors now prioritize strong unit economics, durable business models, and sectors with long-term potential, such as deep-tech, health-tech, and climate-tech. - How are early-stage VC firms reshaping founder journeys in India?

Early-stage venture capital firms are going beyond capital, offering mentorship, go-to-market support, and domainexpertise. This hands-on guidance helps founders build scalable, resilient startups with a clear path to profitability. - Which sectors are gaining traction for venture capital funding in India?

Health-tech, deep-tech, climate-tech, and enterprise SaaS are attracting significant investment. These sectorsbenefit from structural tailwinds, technological innovation, and long-term market demand, making them ideal for enduring startups. - Why should founders focus on unit economics and sustainability for seed funding in India?

Investors are increasingly scrutinizing burn rates, revenue models, and gross margins. Demonstrating sound unit economics and a path to profitability improves a startup’s chances of securing early-stage funding and long-term investor confidence. - What isSeafund’sapproach to building enduring startups?

Seafund invests in early-stage startups with a long-horizon mindset, providing capital, sector-focused mentorship, corporate networks, and operational support. The goal is to build startups that are profitable, resilient, and impactful, not just high-valuation unicorns.

Table of Content

- 1. From Unicorn Fantasies to Unit Economics & Sustainability

- 2. Sectors Gaining Traction: Climate‑tech, Health‑tech, Deep‑tech

- 3. Evolution of VC Models: Micro VCs, Corporate VCs, Sector‑Focused Funds

- 4. How Early Stage Venture Capital Firms Are Reshaping Founder Journeys

- 5. Seafund’s POV on “Enduring Startup Building”

- 6. What This Means for Founders & Investors

- 7. Closing Thoughts

- 8. FAQs